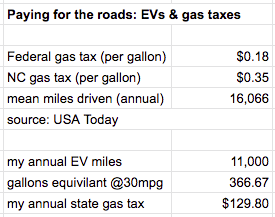

I received my vehicle registration renewal notice in the mail the other day and saw the $130 “electric vehicle fee” included. My first reaction was….. what? that seems punitive!!! But with some calm reflection on mobility and policy, and some “napkin-level” arithmetic, I decided I could let this one go. Right now, I’m 20 cents (2 thin dimes!) short of the state’s benchmark fee, so that’s a pretty good estimate on the state’s part.

For sure, if EV adoption is going to help cope with the climate crisis then any and all of the miles we drive have to be driven on electricity generated from renewables, not coal, not natural gas. We can produce “solar fuel” at home, workplace and community. We should do it!

The deeper questions for me go beyond public policy and who should pay for highway maintenance and construction. Mobility for what? What kind of mobility do we need? What are the social and ecological implications of those choices? Changing land use patterns that increase consumption, including of open space, and that disrupt and fragment communities by building even more roads seems like a dead end to me.